Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

From 0:00 on July 1, EU Customs will terminate the duty-free policy for imported goods with a declared value of less than €22.00.

It means that when EU consumers buy earbuds wireless, Portable Charger, battery charger, etc. from countries outside the EU, they will also have to pay tax when the price is less than €22.

In line with this regulation, the EU has launched the Import One-Stop-Shop (IOSS) to help sellers or EU buyers of e-commerce platforms to collect, declare and pay VAT conveniently, and sellers and buyers can register for an IOSS number on the official website of IOSS in any EU member state (if the business is not in the EU, it is necessary to appoint an intermediary established in the EU to fulfill VAT obligations under IOSS).

We would like to remind you of a few things to know about using IOSS.

1. It applies to goods that meet the following three conditions

1)Issued from a country/region outside the EU

2)The value of the goods does not exceed 150 Euros for B2C shipments

3) No excise duty is payable.

2. If the VAT is paid by the buyer (i.e. the recipient), please remind the shipping customer to ask the recipient for the IOSS number to be marked on the invoice, so that the tax will not be automatically transferred to the sender when the recipient refuses to pay, resulting in losses.

For shipments without an IOSS number on the invoice, the VAT can still be advanced by the service provider/clearance agent on behalf of the customer, but the customs clearance time will be affected, and if the recipient refuses to pay, the tax will be automatically transferred to the sender, which will be borne by the sending customer.

For more information about the change of EU customs regulations, please refer to: For more information about the change of EU customs regulations, please refer to: For more information about the change of EU customs regulations, please refer to

https://ec.europa.eu/taxation_customs/business/vat

For more information on IOSS, please refer to

https://ec.europa.eu/taxation_customs/business/vat/ioss_en

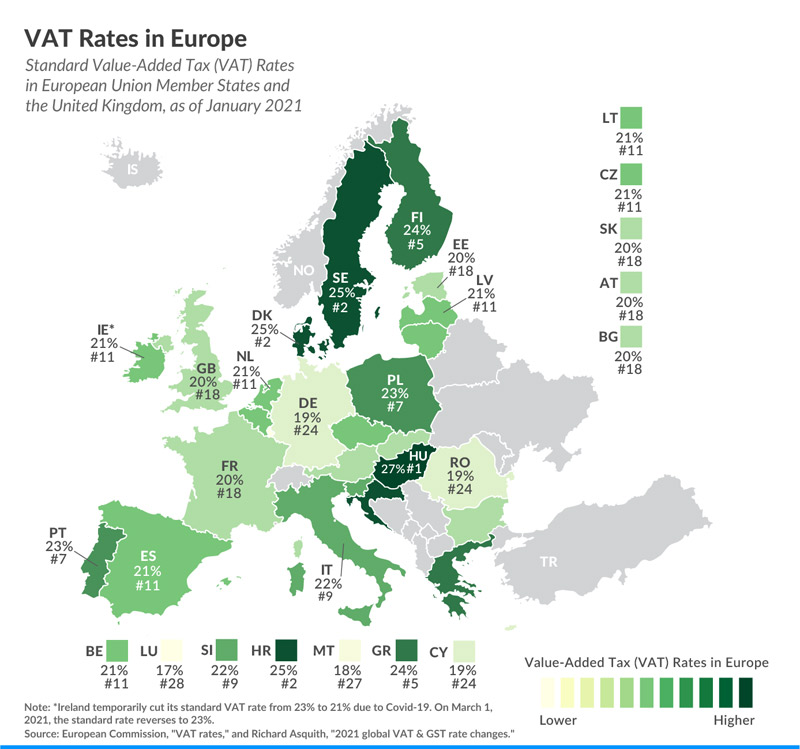

For information on EU VAT rates, please visit the European Commission's website and the websites of national tax authorities at

https://ec.europa.eu/taxation_customs/tedb/vatSearchForm.html

European EU country's direction cargo requirements.

1. The consignee is a company: provide the company registration number

2. The consignee is an individual: local people provide a personal identification number, foreigners provide passport number

3. Shipping must be IOSS tax number, declared value, reflected in the waybill and accompanying invoice above

If the shipper is unable to provide these two items, and the recipient does not cooperate in paying the import VAT tax, the goods may be returned directly or destroyed! At the same time, high return fees and other related costs may be incurred, such as costs will be borne by your company by default, the final bill and the situation shall prevail! It is recommended to communicate with the recipient before shipping to confirm good.

EU countries are Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

Please note that under the terms of the EU-UK Joint Protocol, Northern Ireland will remain within the EU VAT area for goods. This means that these new rules will also apply to goods imported into Northern Ireland from other countries/regions of the world

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

Fill in more information so that we can get in touch with you faster

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.